Friday, 17 April 2015

Who Will Pay For Your Van Insurance Claim?

Today, 17th April, marks the one year anniversary of the collapse of Setanta Insurances. As many of you know 70,000 policies that were held through Setanta Insu...

Today, 17th April, marks the one year anniversary of the collapse of Setanta Insurances. As many of you know 70,000 policies that were held through Setanta Insurances became null and void after the collapse. This meant that people had to part with more hard earned cash in order to make sure that they had valid insurance through another company. Not a single client of Insuremyvan.ie was affected by this as we did not place any of them with Setanta Insurances.

One question that we have repeated been asked over the last year is about those who had open claims with Setanta Insurances after they collapsed. Who will settle the claim? After all, that’s why we have insurance, to cover us financially in the event of a claim against us.

With this in mind, our research department carried out a survey among the general population of drivers with the simple aim of finding out what the public thought the answer should be?

We asked: “If a motor insurance company goes bust, who do you think should pay for outstanding claims?”

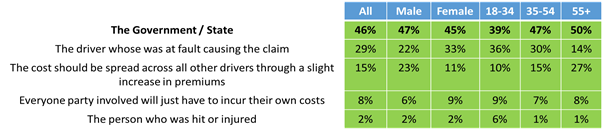

The results that we received; see bottom section of this post; showed us that the vast majority of people (46%) think that the government should pay for outstanding claims if a motor insurance company goes bust. What is surprising is that the average percentage of people who believe this increases with age.

Just 15% of the people that we surveyed said that they think that the cost should be spread across all drivers through higher premiums. Again this percentage increases with age but it is most evident amongst males.

Other findings from the survey revealed that just 2% of people believed that the person who was hit or injured should cover the cost, which contradicts the current situation where these people have been forced to pay for their own repairs or carry these losses because of Setanta Insurances going bust.

Here at Insuremyvan.ie, we have the same mentality as the majority of the survey. We believe that, at least until the whole debacle has been sorted out, the government should step up and pay the cost of the outstanding claims to help alleviate the pressure on those with open claims. Our Managing Director Jonathan Hehir had the following to say about the situation:

Ordinary consumers, particularly the high number of self-employed individuals involved, simply cannot carry this cost, so we are calling on the Minister to upfront payment and cover the relatively small shortfall that may arise.

The handling of the Setanta Insurance debacle by those responsible for the legislative protection in Ireland and consumer protection in Malta has been below par to say the very least. While everyone is aware of the myriad of legal considerations and complexities that exist around the liquidation of a company, particularly when it’s regulated in a different country, it is the end-user, Setanta Insurance customers, who have been essentially been cast adrift.

It should be remembered that when you’re involved in a car crash, and assuming that the accident was your fault, the other party can claim the full cost of their financial loss against you which could amount to tens of thousands or even millions of Euro. Having insurance indemnifies you so this liability transfers to the insurance company.

For Setanta customers that liability currently remains with them which means that the third party is perfectly in their right to extract that debt from them even if it’s costs them everything they have.

What are your thoughts on all of this? You can join the conversation and have your say on Facebook or Twitter by using #SetantaInsurance in your comment.

If you were affected by the collapse last year and you are coming up to your insurance renewal, call our specialist team now 01 660 6900 or you can fill our quote form online and we will give you a great quote for your van insurance.

As well as providing Van Insurance, we also pro vide great rates and cover for Fleet Insurance, Truck Insurance and Public Liability Insurance.

*Appendix*

If a motor insurance company goes bust, who do you think should pay for outstanding claims?

- The driver whose was at fault causing the claim

- The person who was hit or injured

- Everyone party involved will just have to incur their own costs

- The cost should be spread across all other drivers through a slight increase in premiums

- The Government/State